2025 | DYNAMIC BRANDING

BRAND STRATEGY

USER RESEARCH

ART DIRECTION

ROLE

Visual Identity

Design System

Motion Graphics

Case Study

TEAM

Hailey Ho Sang

Luanna Tang

Vicky Li

Ana Lac

TOOLS

Adobe CC

After Effects

Figma

DURATION

15 Weeks

TD Bank is one of the largest banks in the U.S., providing over 10 million consumers access to a full range of financial products and services.

PROBLEM

TD Bank struggles to clearly differentiate itself from peers in a rapidly changing financial landscape, needing a brand identity that more effectively reflects its trusted business model and empowers customers, communities, and colleagues with the confidence to thrive.

SOLUTION

Introducing a more dynamic and community-centered visual identity that reflects the bank's inclusive culture and strengthens the connection between its people, customers, and communities.

BRAND STRATEGY

OUR PURPOSE

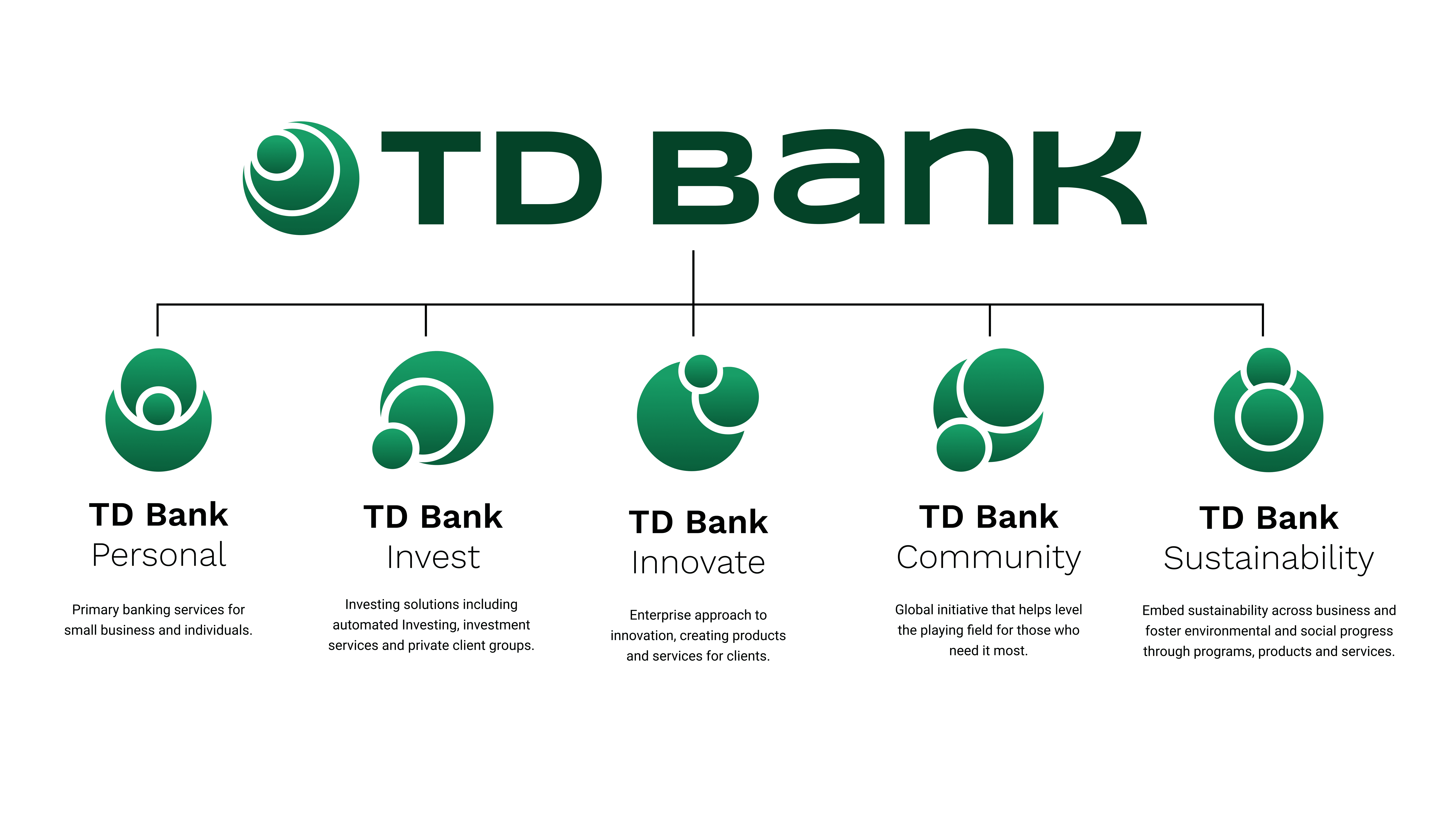

To guide small businesses and individuals by providing the necessary tools to see their business grow, helping the community one step at a time.

OUR VALUE

TD Bank offers small businesses and individuals community-focused financial solutions and inventive digital technologies to help them achieve long-term success.

OUR POSITION

For small business owners and individuals, TD Bank is the financial partner that fosters community and innovation, because we believe in accessible opportunities to succeed.

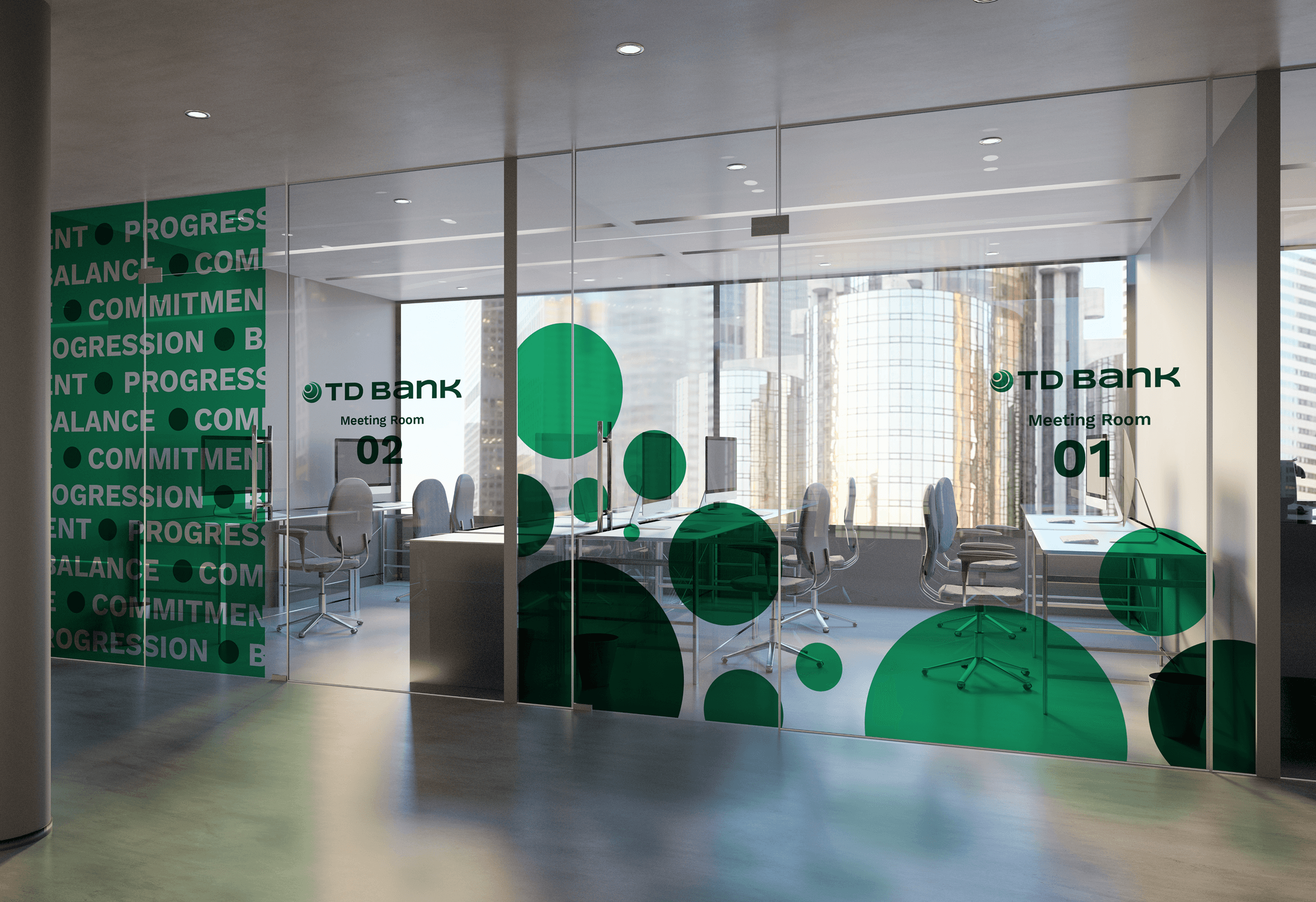

DYNAMIC SYSTEM

DESIGN SYSTEM

KEY TAKEAWAYS

BRAND RESEARCH

VISUAL LANGUAGE

Understanding the importance of a clear, accessible, and brand-focused language played a vital role in the development of the visual language.

PROCESS & REFLECTION

Feedback informed countless rounds of revisions, ensuring a consistency of design system while addressing user pain points.

IMPACT

BRAND RECOGNITION

Increased visibility across digital and physical channels.

Improved customer recall and association with TD's core values.

BRAND POSITIONING

Increased differentiation from rival banks through refreshed identity.

Greater ability to attract new customer segments.

CUSTOMER ENGAGEMENT

Increased interaction rates on digital platforms.

Higher participation in financial products and services.